Since 2023, China's unsaturated resin industry has concluded its earlier rapid expansion and stepped into a stage of structural transition.

Ⅰ. Capacity: Expansion vs. Low Utilization, Oversupply Emerges

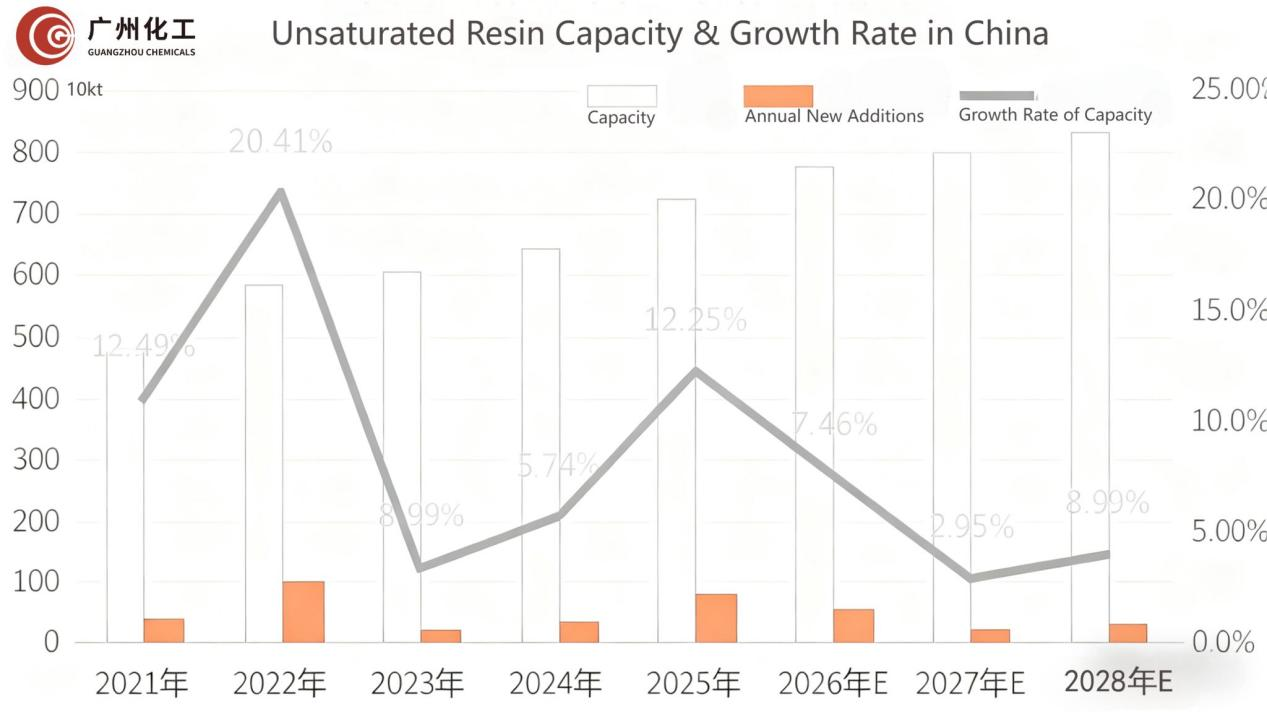

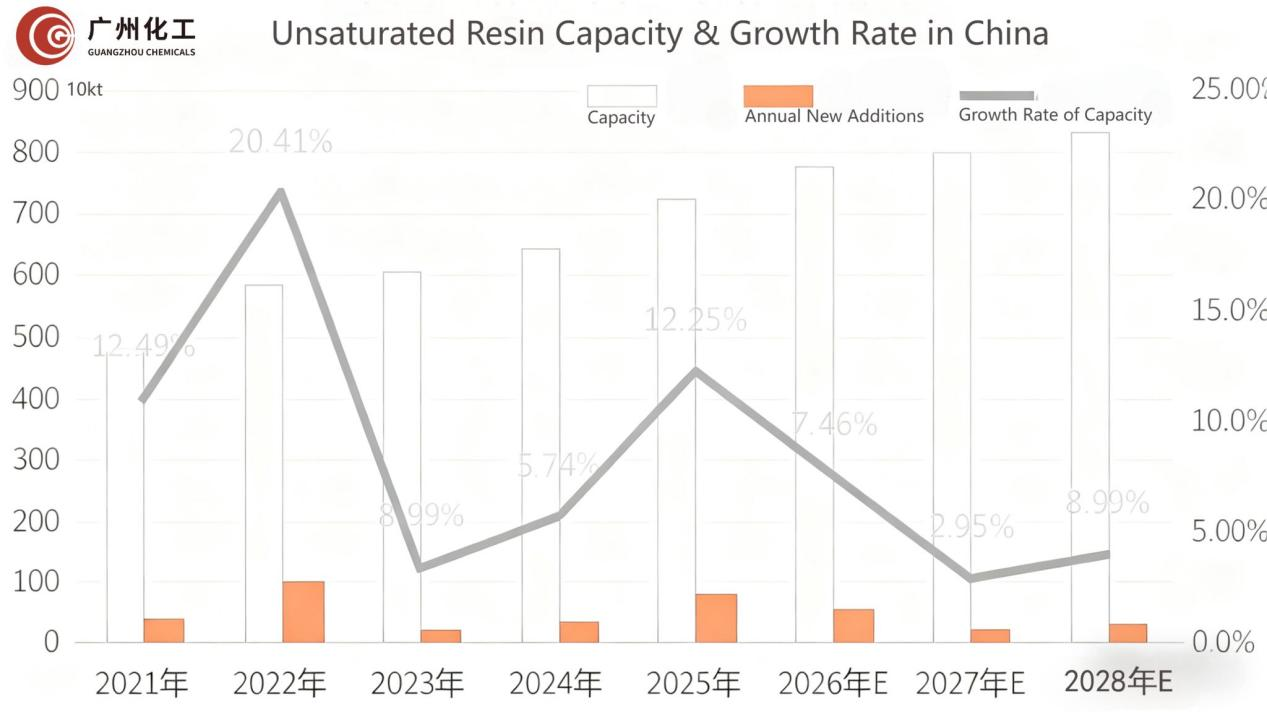

- Rapid expansion (2021-2023): 1Mt new capacity in 2022 (20% growth); 790kt new in 2025(12% growth).

- Total capacity 7.24Mt by end-2025, but H2 2025 utilization down to 31.5% (YoY -5.5pp), monthly output -10.46% YoY; oversupply dominates.

- 1.1Mt new capacity to come (2026-2028); 2025-delayed capacity due to saturation, end of blind expansion.

Ⅱ. Constraints: Dual Pressure-Weak Demand & Falling Costs

- Demand: New energy vehicle demand dividends not fully transmitted;building materials/coatings (key traditional sectors) see sluggish rigid demand; weak overall support.

- Cost: Core raw material styrene prices weaken; industrial chain costs drop; enterprises adopt low-inventory and dynamic operating rate adjustment strategies.

Ⅲ. Trend: Scale Expansion-Value Innovation

- Fundamental shift from extensive scale expansion to refined structural optimization.

- Competition focus moves to value innovation; blind expansion ends industry enters an intensive cultivation cycle.

Strategic Partnership & Consultation

As the Chinese unsaturated resin market matures and competition pivots towards value innovation and structural optimization, having reliable market intelligence and a robust supply chain is crucial.

Guangzhou Chemicals Imp. & Exp. Co., Ltd. is committed to navigating this complex transition alongside our partners.

To gain further insights, detailed market consultancy, or to find a reliable, high-quality unsaturated resin supplier in China capable of meeting stringent compliance and value requirements, please contact our professional Sales Specialist Riley Zhu.