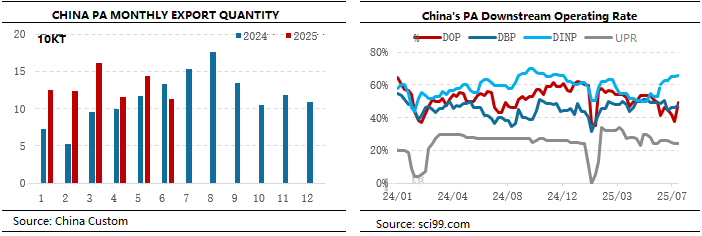

With rising temperatures, the domestic phthalic anhydride downstream industry has entered its traditional off-season, slowing raw material consumption. Operating rates for major downstream industries have declined, with the exception of some DINP units operating at higher capacity due to maintenance. The monthly average operating rate for DOP was 44.02%, a decrease of 2.83 percentage points month-over-month; the average operating rate for DBP was 46.44%, a decrease of 2.84 percentage points month-over-month; and the average operating rate for UPR was 24.6%, a decrease of 0.4% month-over-month. Regarding exports, phthalic anhydride exports in June reached 11.32 thousand tons, a decrease of 21.04% month-over-month.

The following is an analysis of core data on China’s phthalic anhydride exports in the first half of 2025, based on customs and industry statistics:

Cumulative Export Volume: From January to June, it reached 78,239 tons, a year-on-year increase of 36.63%.

Quarterly Performance: Q1 exports reached 40,998 tons, a year-on-year surge of 84.39%. Q2 exports reached 37,241 tons, a 9.2% decrease from QoQ, but overall growth remained resilient in the first half of the year.

April: Exports reached 11,582.5 tons, a sharp drop of 28.13% from QoQ, with an average price of US$899.87/ton.

May: Exports rebounded significantly to 14,337.6 tons, a 23.79% increase from QoQ, with an average price of US$888.1/ton.

June: Exports declined again to 11,321 tons, a 21.04% decrease from QoQ, with an average price of US$866/ton.

The main reasons for the fluctuations include tight supply of raw material o-xylene, leading to production cuts at domestic phthalic anhydride plants (e.g., maintenance at multiple plants in East China from March to April), and changes in downstream purchasing patterns.

The average export price showed a gradual decline in the first half of the year, from $899.87/ton in April to $866/ton in June, reflecting intensified international market competition and weakening cost support.

India, the United Arab Emirates, Vietnam, Saudi Arabia, and Pakistan account for nearly 60% of total exports.

Exports to the US account for less than 1%, and the tariffs imposed on PVC products have not had a significant impact on direct phthalic anhydride exports.

Although phthalic anhydride exports showed monthly fluctuations in the first half of 2025, total exports still achieved year-on-year growth of over 36%, benefiting from infrastructure demand and price differentials in Southeast Asia and the Middle East. In the second half of the year, attention should be paid to the stability of raw material supply and the sustainability of orders from emerging markets.

(Data Source: General Administration of Customs People's Republic of China)

Edited by: Jeffery Cheng